“Let us be grateful to the people who make us happy; they are the charming gardeners who make our souls blossom.”

~ Marcel Proust (French Author 1871-1922)

-

- U.S. and Global equity markets continue to surge, despite the ongoing circumstances of an at-times chaotic year.

- Labor markets showing signs of strain pushed the Federal Reserve (the “Fed”) to resume its rate-cutting campaign.

- 2025 may have had a seemingly high degree of uncertainty, but even with this overhang, investors have much to be thankful for.

Autumn leaves have fallen. The Dodgers won the World Series, and football season is now in full swing, while families and friends are preparing for the upcoming holiday season. At some point, conversations may turn to markets, the economic environment, entertainment, politics (although we recommend steering away from this topic at Thanksgiving dinner), and more. Eventually, discussions may shift to gratitude. Investors may not perceive much reason for optimism, but with only about a month left in 2025, markets remain remarkably resilient. There are a number of reasons other outcomes could have occurred, but as is usually the case around this time of year, there are plenty of things to be thankful for.

Looking back, the turmoil of early 2025 gave way to a sizable market rebound that was likely driven by multiple factors. For example, favorable changes in monetary policy may result in consumer and business benefits. Strong corporate earnings likely also contributed to the rally, in part due to an inflection point for artificial intelligence (“AI”). What many may have viewed as a mere technological concept without relevance to their lives is now having a tangible impact on Americans and may also be driving material growth in our economy. The past year should be a trigger for all investors to remember that investment discipline and long-term thinking are critical, regardless of market volatility.

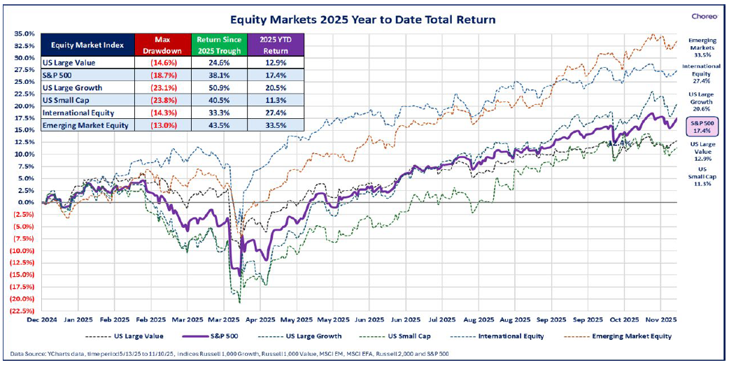

Strong Equity Market Performance

One of the most notable bright spots in 2025 has been the performance of global equity markets. The S&P 500 dropped by almost 19% through early April but has rebounded substantially. Stocks had been under pressure earlier this year due to the uncertainty and implications of a new presidential administration (primarily around negative ramifications of new tariff policies on inflation, global trade, and geopolitical tensions), leading to a bottoming out in April, shortly after President Trump’s tariff announcements. Since then, several key factors have driven equities steadily higher. Strong corporate earnings continued in spite of tariffs and associated fears about increased inflation. The positive developments around AI have not only led to outsized returns for firms supporting or facilitating AI advancements, but also to the increasing number of companies harnessing AI capabilities to achieve growth and efficiencies. Additionally, seeing that fears about the impact of tariffs may have been overblown has helped erase losses and validate the rebound.

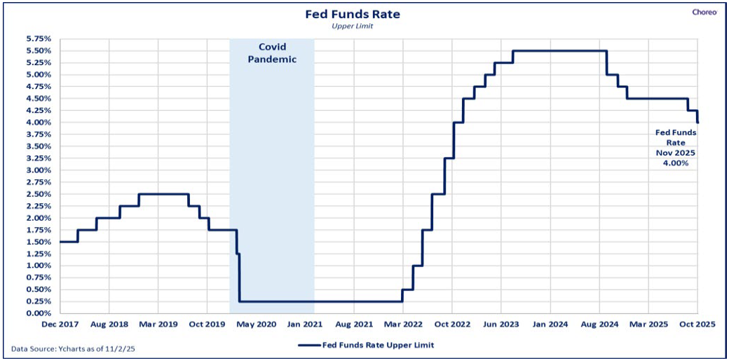

Easing Monetary Policy

Another item investors can be thankful for is the Federal Reserve’s resumption of interest rate cuts. After lowering rates by 100 basis points in 2024, the Fed paused further cuts for about nine months. The central bank resumed easing in September and continued in October, with prospects for additional cuts under consideration. Lower interest rates can be helpful for consumers and businesses: for instance, mortgage rates dropped to roughly 6.25% today, down from 7.25% at the start of 2025. Lower rates also tend to create positive ripples across the economy. All else being equal, lower interest rates mean a lower cost of borrowing, which can stimulate economic activity, particularly in rate-sensitive areas, such as real estate and bank lending.

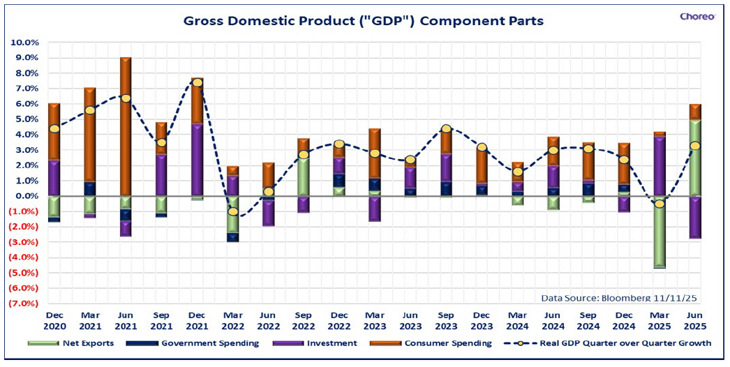

Resilient Economic Growth

Despite persistent geopolitical tensions and trade uncertainties, U.S. economic growth has continued its resilience. GDP has remained generally positive following a small dip in Q1 2025. Again, this show of strength (despite the economic uncertainty created by the prospect of higher tariffs) came as a surprise to many economists. Abroad, emerging markets and many developed nations benefited from a weaker U.S. dollar as many countries hold dollar-denominated debt. This debt is less expensive to service as global currencies appreciate against the greenback, freeing up capital and reducing default risk, amongst other benefits.

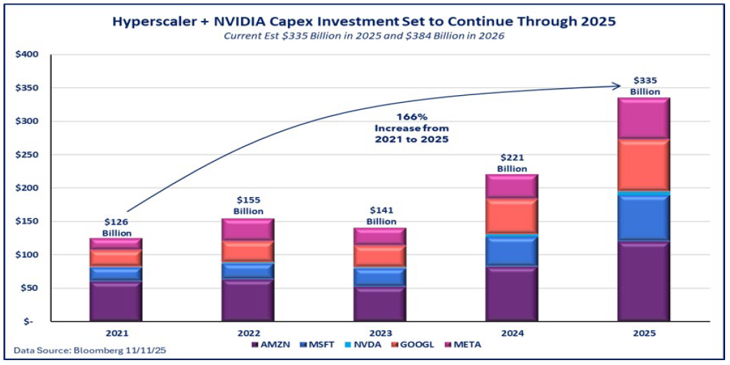

The AI Investment Boom

Since November 2022, when OpenAI launched ChatGPT, artificial intelligence has moved from curiosity to a global priority. It now sits at the center of geopolitical strategy, corporate budgets, and large-scale infrastructure planning. The resulting investment boom has been extraordinary: major cloud providers like Google, Amazon, and Nvidia have increased capital spending by 166% since 2021, adding more than $200 billion of new investment.

These additional tech investments have become a real economic engine, with data-center construction and AI-related spending making a noticeable contribution to U.S. GDP growth in the first half of 2025. Even though the long-term use cases of AI are still in development, the infrastructure phase is already delivering tangible benefits, including more construction, more jobs, higher utility demand, and a surge in semiconductor orders. Together, these have helped support overall U.S. economic growth.

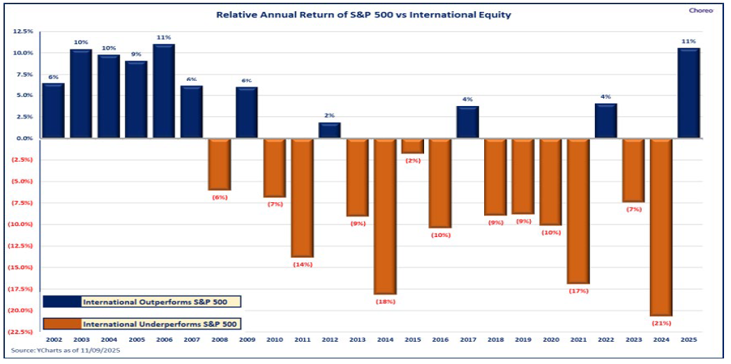

International Stocks

For the first time seemingly in forever, international developed and emerging stocks are having a moment. The primary international indices surged well ahead of U.S. markets this year due in part to U.S. dollar weakness as well as other factors. For the globally diversified investor, the outcome boosted 2025 performance.

CONCLUSION

In a year that began with heightened uncertainty, 2025 has delivered a wealth of reasons for investors to feel real gratitude. From strong market performance and monetary policy easing to sector innovation and solid economic fundamentals, the investment landscape continues to reward patience, adaptability, and strategic, long-term thinking. At Choreo, we are most grateful to our clients, professional partners, friends, and families. We feel an enormous sense of gratitude and humility for your trust and confidence as we help you navigate this ever-changing investment landscape in pursuit of your financial goals. We wish you and yours a joyful and prosperous Thanksgiving, and as always, please reach out to us with any questions or comments.

Disclosures

The performance numbers displayed herein may have been adversely or favorably impacted by events and economic conditions that will not prevail in the future. Past performance does not indicate future results and investors may experience a loss. The indices discussed are unmanaged and do not incur management fees, transaction costs or other expenses associated with investable products. It is not possible to directly invest in an index.

Opinions are expressed as of the date indicated, are subject to change and are based on sources considered reasonable by Choreo.